About us

Carmeuse Ventures is an early-stage corporate venture capital firm investing in climate & construction deep tech. As an active investor, Carmeuse Ventures can build upon over 165 years of industrial experience in limestone and lime production. We separate ourselves by creating win-win, beyond capital. We want start-ups to leverage our internal competences like our unique engineering capabilities in lime production & decarbonization, a fast market access and our global scale. This leverage results in delivering a value increase in the start-up. We are founder friendly and institutional VC friendly.

Investment Focus

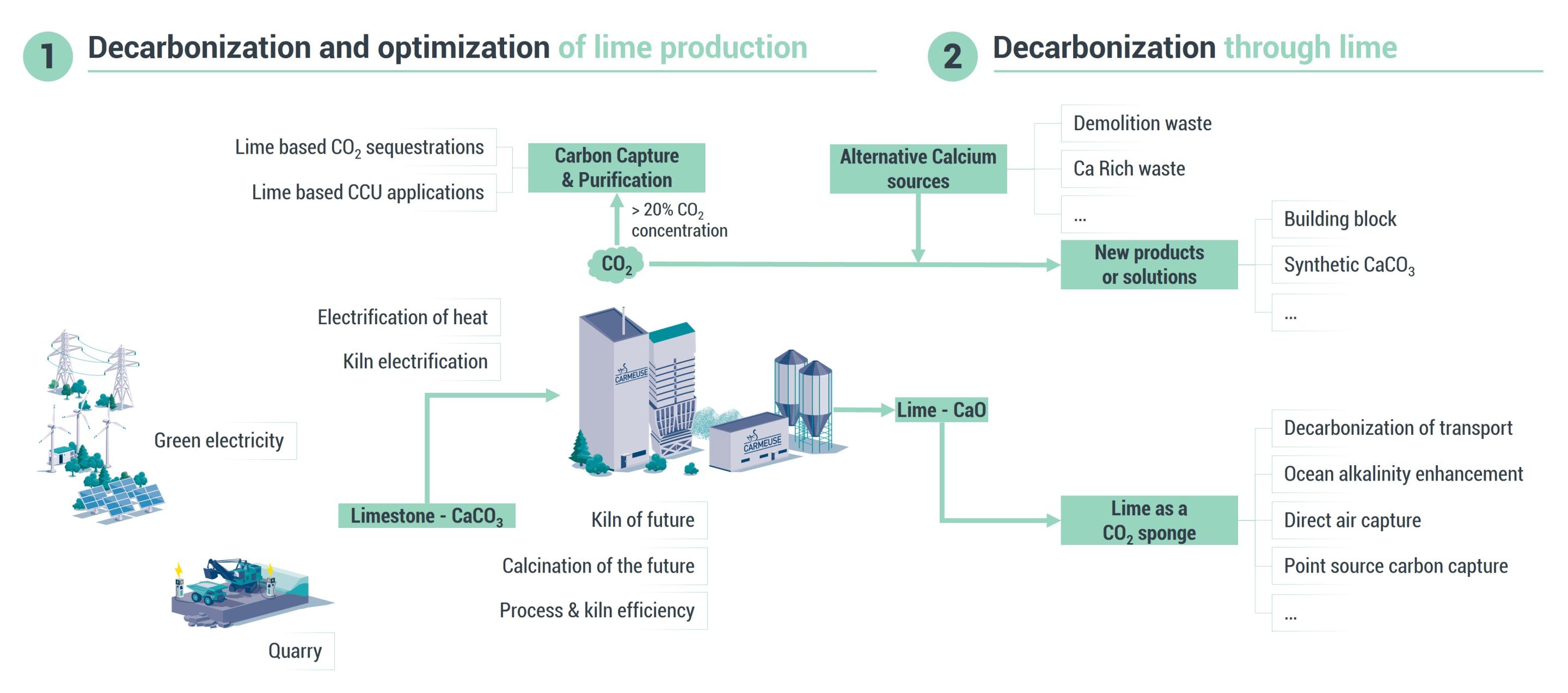

Carmeuse Ventures invests in SEED and series A rounds. Our investment scope is focused on tackling lime’s CO2 intensive production process while leveraging the unique functionality of lime to capture CO2 to decarbonize our society and build new lime(stone) products & solutions. Consequently, our investment scope is split into two pillars:

- The decarbonization and optimization of lime production which, among others, covers kiln electrification and optimization of kiln technology, the calcination or lime production process and carbon capture utilization and storage solutions.

- The decarbonization through lime which, among others, covers ocean alkalinity enhancement, direct air capture, decarbonization of transport, carbonation/mineralization technology, carbon dioxide removal through lime, new (green) lime and limestone products.

What can we offer you?

Carmeuse Ventures wants start-ups to leverage our internal competences to create win-win, beyond capital. Over its 165 years of existence, Carmeuse has developed a unique industrial expertise ranging from mining to carbon capture.

We have testing possibilities at our lime plants and quarries, spread across the globe. In that regard, we would like to highlight our 30 ton per day oxyfuel demo kiln in Belgium. The facility can vary its CO2 emissions between 20% to close to 90%, making it the perfect set-up to test start-up’s carbon capture technologies with industrial flue gasses.

This demo facility is the results of our strong engineering capabilities. As a matter of fact, Carmeuse is the only lime player which is able to construct in-house engineered full BAT turnkey lime plants. Our engineering knowledge can be used by start-ups to accelerate their solution to industrial scale.

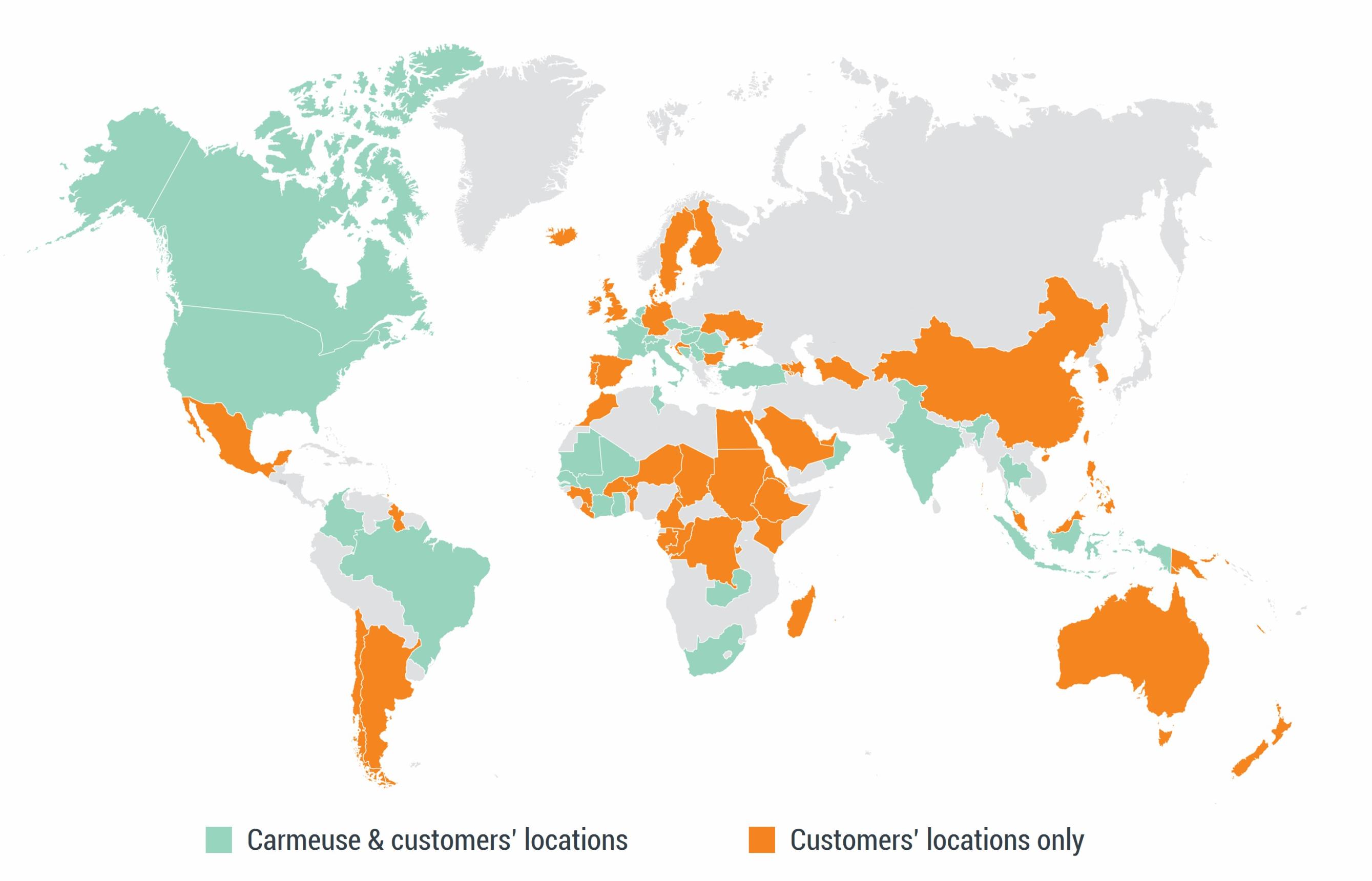

As a global player we are more than happy to bring your solution to our customer network of over 13 000 customers in 90 countries.

Giving you the fastest route to the market at a global scale.

Dr. Tom CROYMANS

Corporate Venture Fund Lead

With profound expertise in the field of Carbon Capture, Utilization, and Storage (CCUS), Tom Croymans has been making significant strides in the industry since 2019. Before joining Carmeuse Ventures as Corporate Venture Fund Lead, he was at the helm of the innovation and carbon capture departments at a leading global waste-to-energy technology supplier. His leadership extended to the industry association ESWET (European Suppliers of Waste to Energy Technologies), where he chaired the CCUS Working Group. He is the main author of ESWET’s follow-up report of the Global Carbon Capture and Storage Institute’s publication regarding carbon capture and storage for waste-to-energy. Holding a postgraduate degree in business administration, his unique blend of technical knowledge and business acumen positions him as a key driver of Carmeuse Ventures' mission to support and propel innovative start-ups.

Aurélie DUSAUSOY

Group Director of Strategy and M&A

Aurélie is a seasoned professional with extensive experience in corporate finance, tax, and strategic management. Throughout her career, she has demonstrated a remarkable ability to lead high-impact projects and manage complex financial transactions. Before taking on her current role, Aurélie held the position of Group Corporate Finance and Tax Director. Aurélie’s academic credentials include a Master in Business Engineering and a Master in Taxation from Solvay Business School. This impressive blend of strategic vision and financial expertise positions her as a pivotal force in guiding Carmeuse Ventures towards sustainable growth and innovation. Her profound understanding of corporate finance and strategic management, coupled with her dynamic leadership, significantly contributes to Carmeuse Ventures' mission to support and propel innovative start-ups.

Our Portfolio

Integrated carbon capture and storage tapping into the ocean as a carbon sink.

Climate technology company developing carbon capture solutions for existing coastal bioenergy and industrial facilities.